Our payroll service can be tailored to meet your requirements, we have suitable packages for small to medium businesses.

• We are experienced in providing payroll services to a vast number of businesses in terms of size and industry sector.

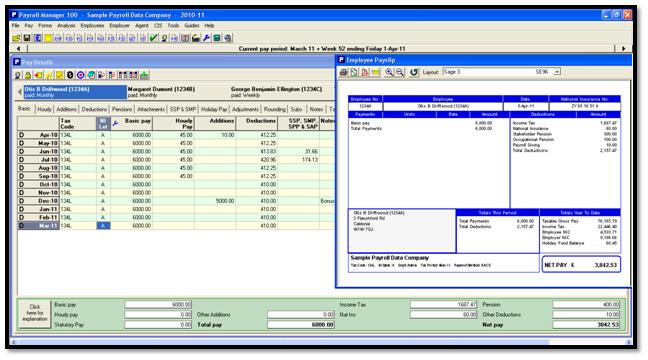

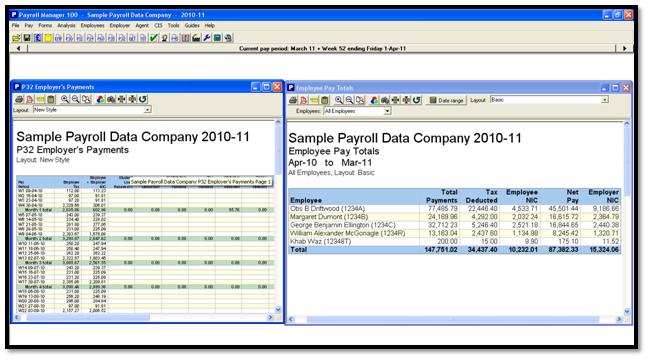

• We can supply payroll services for weekly, bi-weekly, four weekly and monthly payrolls.

• No set up charge.

• Fixed rate for administering the payroll service.

• Transparent pricing policy regarding additional payroll services such as BACS transfer and paper reports or payslips.

• All types of payroll service deductions are administered, i.e. Pensions, student loans, reduced hours etc.

• Payroll service is completely scalable in the event employees need to be added or removed from the payroll.

Real Time Information

The introduction of RTI is deemed by the UK government to be essential to reforming the social security benefits system. It is proposed that the current ragbag of benefits be replaced by a single system of universal credit in October 2013.

Employer Involvement and Timescale for Introduction

Presently, to the extent that pay and tax information impact upon benefits entitlements, those entitlements must necessarily be set or adjusted retrospectively following receipt of that information post each tax year end of 5th April when the annual returns are submitted. The RTI system proposes that the payroll information be submitted to the Revenue at each payroll run such that benefit entitlements can be established or adjusted more or less immediately.

No doubt the idea is sound from the point of view of the Government (representing the general taxpayer) and benefits claimants (if not all). The drawback for employers is that it will be an additional demand within the PAYE burden. The information provided to the Revenue will be made available immediately to the Department for Work and Pensions.

It is presently intended that large employers (those with 250 employees or more) will begin to be brought into the scheme from April 2013 with small and medium-sized employers following on later in that year.

The intention is that all will be on the RTI system by the end of 2013.

Preparation and Initialisation

A preliminary step before RTI can be operated is for each employer to carry out a ‘ Payroll Alignment Procedure’. An extract must be provided to the Revenue with all relevant detail of all employees in the current tax year. The Revenue will compare the information to their own and appropriate adjustments will be made. Each employer will receive its own ‘ invitation ‘ to join RTI. The first RTI submission must contain the payroll extract for payroll alignment.

The payroll submission to the Revenue will be known as a Full Payment Submission (FPS). The very first FPS will give the details of every individual employed since the beginning of the tax year even if no longer employed at that date). In some cases the payroll alignment will be carried out by way of a separate submission known as an Employer Alignment Submission (EAS).

It will be vitally important to get the EAS completed correctly. There will be no facility for an employer to make amendments so that if an employee is not included the Revenue will consider them to have left. (This unnecessary lack of flexibility is a sure source of problems.)

Presumably by way of oversight, the system does not provide for changes in employee’s personal details, such as change of name on marriage and change of address, to be submitted. It will remain the responsibility of the individual employee to notify the Revenue directly of such changes.

Best preparation is to ensure that the records of your employees are complete and up-to-date and that your finances are adequate to pay the full sums of PAYE on time (and thus minimise automatic PAYE late payment surcharges).

Impact on Employers and Employees

Employees should also benefit from an improvement in the accuracy of PAYE coding notices to reflect their personal circumstances (any improvement would be welcome).

One not widely recognised side-effect is likely to be that PAYE payment defaults and penalties will soar since the Revenue will know exactly how much PAYE is due each month and thus those employers who pay over sums ‘ on account ‘ may well find automatic defaults being recorded against them.

Another practical impact is that it will no longer be possible to include individuals in the payroll without all of the following details:-

- Full name

- Date of birth

- National Insurance number

- Home address

- Employment circumstances when joining i.e. whether it is their first job since 6th April previous, their only job, or if they have another job

The information forwarded will include the number of hours worked (used to calculate tax credits, student loan repayments and so on).

As a result of RTI the annual submissions of payroll summaries P35 will not be required.

If operating your own payroll you must ensure that your payroll system permits RTI. The alternative is to instruct a payroll provider such as us to operate your payroll and deal with RTI for you at the same time.

The accounting for Benefits in Kind through the P11D system will not be affected.

Information will need to be submitted for all employees including students and those earnings below the lower earnings limit (for which no NI is payable) and ‘casuals ‘.

Details of Construction Industry Scheme payments (CIS) will be included as well as details of statutory entitlements such as statutory maternity pay (SMP), statutory sick pay (SSP) etc.

It was originally intended (and is still an eventual intention) that the BACS system be utilised, but inherent difficulties have precluded that option at the outset and the Electronic Data Interchange (EDI) or Government Gateway will continue to be used for the submission of RTI for the time being.

It will not be necessary to pay employees through BACS.

P60 end of year earnings and tax certificates will still need to be issued.

It is now understood that P45s will continue for the time being in place of the proposed leaver’s statement.

The new system will require a monthly employment payment submissions report to be made to the Revenue. This will reflect offsets for statutory payments such as SMP and SSP and tax suffered under the CIS.

Late filing penalties can be assumed.

Our Clients

We will be assisting our payroll clients through this new obligation.

The additional cost of the RTI imposition on our service cannot yet be known, but once established will be reflected in your payroll quotation in due course.

Paying attention to our payroll submissions to you promptly should avoid late RTI submission penalties.

We propose to operate a ‘negative approval ‘ process for RTI such that your payroll will be carefully prepared and double checked in the ordinary way and submitted to you for final approval. It will be impracticable to seek a separate RTI approval from you in each case so we shall deem your acceptance of our payroll to be approval for RTI submission purposes and thus will go ahead and make the RTI submission unless we hear from you to the contrary.